Facts About Paul B Insurance Revealed

They also aren't an official advantage, so they're generally simpler to take care of and also have fewer administrative expenses. Nevertheless, since they aren't a formal advantage, staff members can use their stipend to acquire whatever they want. So, while you may want your employees to make use of the cash on health insurance or clinical expenditures, they aren't required to do so, nor can you ask for evidence that they acquired a medical insurance plan.

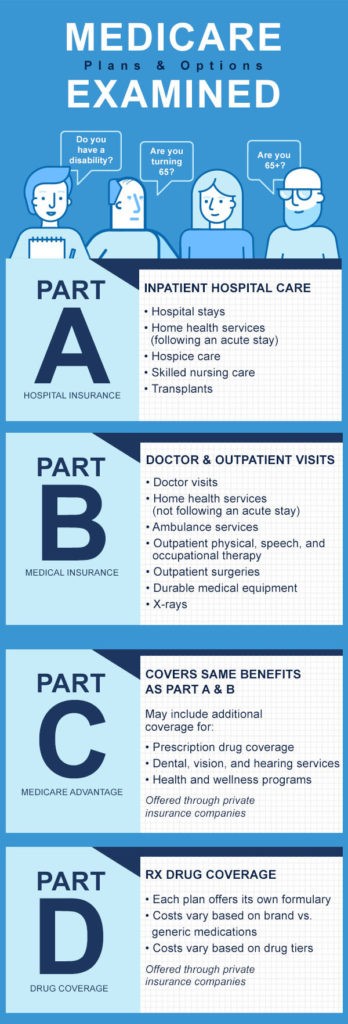

Healthcare facility cover is readily available in four different rates, specifically Gold, Silver, Bronze, as well as Standard, each covering a mandated checklist of therapies. Since Gold plans cover all 38 sorts of treatments laid out by the government, they also come with the most expensive costs.

In 2017, the typical insurance policy costs for United States family members with employer-sponsored health insurance coverage cost $18 764, an increase of 3% over the previous year. What this mean worth hides, nonetheless, is the substantial difference in the amount of health and wellness care obtained by different individuals in the USA. vinnstock/i, Stock/Getty Images That difference is mirrored in substantial differences in healthcare spending.

The Best Strategy To Use For Paul B Insurance

Plans intended at improving this feature of medical insurance include covering annual out-of-pocket expenses, ending lifetime advantage limitations, as well as ensuring insurance coverage for people with preexisting conditions. 2. The academic function of insurance might be protection from devastating occasions, a much more usual function of health insurance coverage in the United States is much much more akin to a club membership than cars and truck insurance coverage.

Urging slim networks could acquire reduced prices, but at the cost of leaving out high-quality companies (if costs are concordant with high quality). While the above list is an effort to specify the features of health and wellness insurance coverage in the USA, it would certainly be much much shorter if we described just what medical insurance is successful in doing well.

A succeeding analysis of workers' compensation cases and also the degree to which absence, morale as well as working with great workers were troubles at these companies shows the positive impacts of supplying medical insurance. When contrasted to organizations that did not supply medical insurance, it appears that providing FOCUS led to renovations in the capability to employ excellent workers, reductions in the variety of employees' settlement insurance claims and also reductions in the degree to which absenteeism as well as efficiency were issues for FOCUS services.

Paul B Insurance Fundamentals Explained

6 reports have been released, consisting of "Care Without Insurance Coverage: Inadequate, Too Late," which discovers that working-age Americans without health insurance are most likely to obtain insufficient healthcare and obtain it too late, be sicker and die quicker and also receive poorer care when they remain in the health center, even for intense scenarios like a car collision.

The study writers also note that broadening insurance coverage would likely lead to an increase in real source price (regardless of who pays), due to the fact that the without insurance obtain you could try this out regarding half as much healthcare as the privately insured. Wellness Matters published the research online: "Just How Much Treatment Do the Without Insurance Usage, and also Who Pays For It?." - Paul B Insurance.

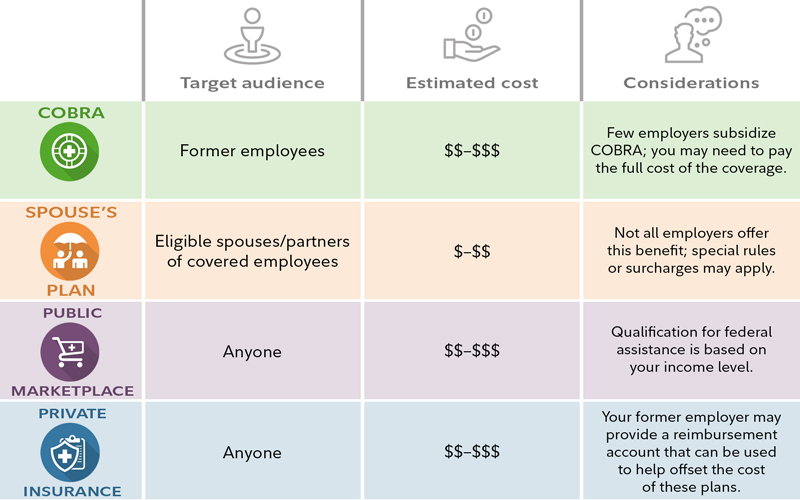

A medical insurance plan is a kind of insurance policy that aims to offer you as well as your household with the financial capacity to invest for any kind of unfortunate case that needs medical care and hospitalization. If you're really feeling unpredictable regarding getting one, here's what you need to learn about medical insurance as well as the pros and disadvantages of availing a wellness insurance policy plan to help you decide.

The Only Guide to Paul B Insurance

However as many individuals from the insurance policy sector will inform you, "You can't place a cost on wellness." That claimed, right here are a few of the benefits of availing a medical insurance plan - Paul B Insurance. Reduced prices for dependable health and wellness care vs. expense prices if you do not have a medical insurance plan Accessibility to readily available clinical interest Wide choice of strategies that use a variety of advantages appropriate to your health as well as health The primary negative aspect to getting health and wellness insurance is the cost, as the different medical insurance plans can necessitate greater costs about numerous variables consisting of the standing of advice your health and wellness, your age, your way of living, etc. Expensive premiums as a result of pre-existing health problems (health and wellness insurance coverage service providers need those with specific pre-existing health and wellness problems to pay a greater costs because of the higher likelihood they have of making use visit homepage of the insurance coverage as well as the price it would consider treatments and hospitalizations) Complicated policies, offered the similarities and also differences of each wellness treatment insurance plan If your plan doesn't cover the clinical focus or service that you need, or if the hospital expenses surpass the allowable insurance coverage, you will still have to shell out some money Weigh your choices and also very carefully determine which health and wellness insurance strategy works best for you and also your family.